I'll start by explaining how to build a really quick and simple budget plan.

A quick household budget plan is a brilliant, easy way to keep you in financial tip-top condition. If you DO have financial worries, this can be a gentle kick start (but you might need to seek further help - I'll share some links at the end of the post)

Get yourself a pen and paper, and a cuppa, this shouldn't take too long. The first time I did a basic budget we had 1 bank account and used debit cards for everything. So I just used a couple of monthly statements.

Otherwise gather together credit card and bank account statements, shopping receipts, and as much of that kind of paperwork you have available from the past few months.

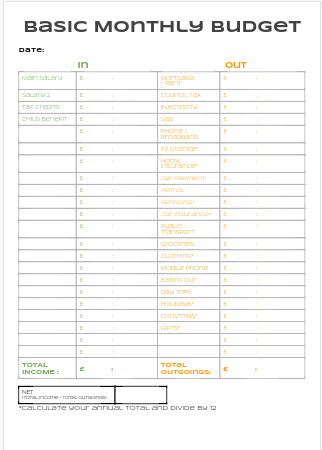

I have made 2 printable PDFs available to download: Our basic monthly budget sheet or a BLANK budget sheet (if the downloads don't work for you let me know and I'll see what I can do)

or... grab a sheet of paper, a notepad, the back of an envelope, whatever... and draw a line down the middle.

On the left hand side write down:

What payments you have incoming during an average month?

including employment, benefits, pensions, income from investments,etc

In the other column write down:

What payments you have outgoing in an average month?

Including any direct debits, rent/mortgage, council tax, gas, electricity, internet, phones, insurance policies, petrol, bus/train fares, loan repayments, grocery shopping, nights out, subscription packages, charity donations, etc Don't forget the big annual outgoings (Add these together and divide by 12) Including one off insurance payments, holidays, Christmas, clothing and footwear, furniture, gifts, etc

Now take outgoings away from incomings

You should have a positive number.

If you have a negative number, you need to go through all the outgoing figures and see where it is sensible to cut back as soon as possible.

Now that you have gone through everything perhaps you can see where you overspend?

What can be gently tweaked to save you an extra few pounds?

Try cutting 10% off your grocery bill, cut clothing and footwear in half (the budget that is... not your clothes...obviously) Shop around to get a better deal with car insurance, electricity, mobile phone, etc.

We do a simple budget at least once a year just to keep us on the right track.

If you want to dive in at the deep end and do a full warts-and-all audit, I highly recommend getting your planner from Martin Lewis Money Saving Expert - available here. It is completely free, horribly detailed, will take an hour+ to work through and will ensure you don't miss anything out.

If you are struggling to cut back, please get help, a sensible friend is a good place to start if you have one available. Read through some of the information on the Money Saving Expert website - here - or contact your local citizens advice bureau.

* * *

Now that we are on the other side of debt, we realise that forcing ourselves to live on a strict budget in the past has conditioned us and we are better placed to prepare for our future.

No comments :

Post a Comment

I love getting your comments, they really make my day! I try to respond when I can.

I moderate all comments to cut out the stinky spam. So please be patient if it hasn't popped up immediately.

If you ask a question remember to check back for an answer later.

Thank-you, you wonderful peeps!